Deadlines for the Inflation Reduction Act

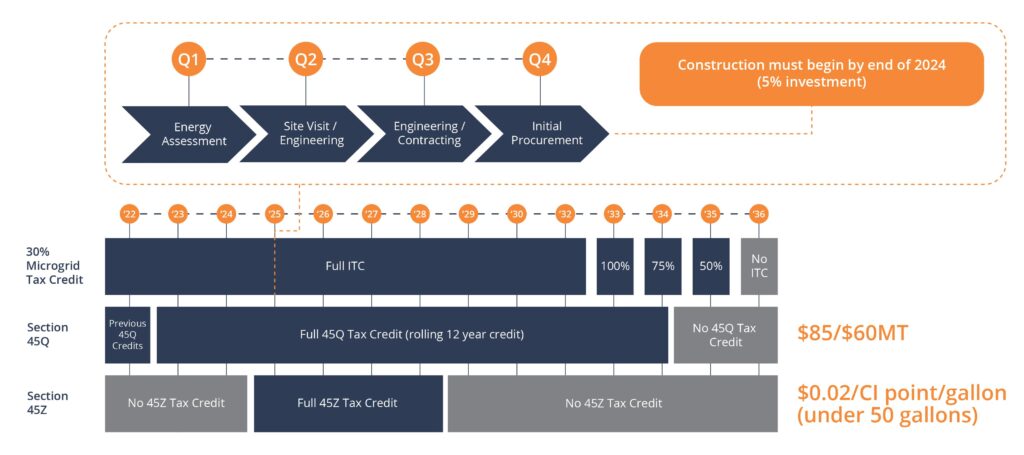

Time is running out to make the most of the Inflation Reduction Act’s 30% microgrid ITC. In order to hit the December 2024 deadline, companies need to get their renewable energy projects in motion now.

Stay ahead of the deadlines for the Inflation Reduction Act. Here are the key timelines you need to know for maximizing your benefits.

For U.S. facilities looking to take action on their sustainability goals, the Inflation Reduction Act (IRA) is a windfall to accelerate and achieve their energy transition goals, as it offers an array of financial incentives, including refunds and investment tax credits (ITCs).

The time to act is now, as many of the incentives are time-limited. Below are the timeframes across some of the IRA’s key incentives and how Unison Energy can help you take advantage of these financial opportunities to help your organization achieve its GHG goals.

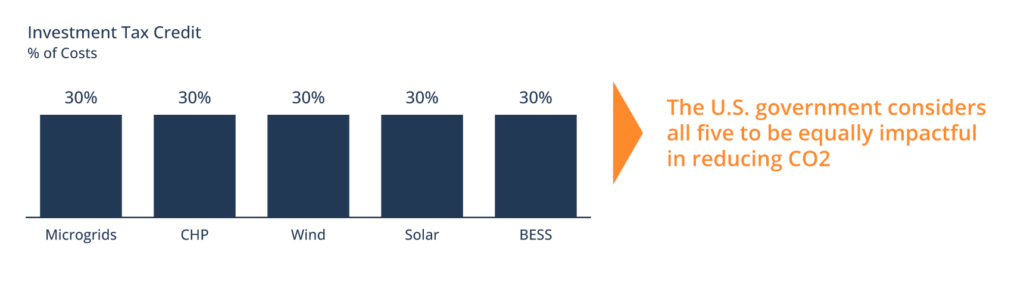

Microgrids: The IRA offers a 30%+ ITC for clean energy projects

By 2025: A 30%+ ITC applies to various types of clean energy projects that start construction before the end of 2024 and meet the prevailing wage and apprenticeship requirements. This applies to technologies such as combined heat and power (CHP), solar, battery storage, microgrid controllers, microturbines, fuel cells, and biogas. A 10% bonus is available for domestic content, with an additional 10% for projects located in designated energy communities. Under the safe harbor rules, as long as 5% of project costs are spent prior to the end of 2024, the project will qualify for the full credits, thus effectively extending the construction period for qualifying projects into 2025.

From 2025 to 2032: The time to act is prior to January 2025. After this point, the tech-specific ITC will be replaced by the new, tech-neutral Clean Electricity ITC (48E). This emissions-based incentive allows for an ITC credit of 30% in the year the facility is placed in service, plus relevant bonuses. The Treasury Department will publish emission rates and eligibility guidelines for qualifying projects annually.

These credits will phase out in 2032 or whenever annual greenhouse gas emissions from electricity generation are 75% lower than in 2022.

Work with us: Unison Energy provides custom turnkey microgrid solutions for our clients. We can incorporate various technologies based on your goals, maximizing your IRA benefits.

Hydrogen & Biogas: The IRA supports clean fuel production for the next decade

From 2025 to 2028: The full 45Z tax credit is available for clean fuel produced beginning in 2025 and sold before 2028. Under IRA credit 45Z, from January 1, 2025, through December 31, 2027, each point reduced in a fuel’s Carbon Intensity score (below 50, per the GREET model) is worth $0.02/gal or about $2 to $10 million per year for an ethanol refinery.

By 2031: Until 2031, $500 million is available for competitive grants with up to a 75% cost share, supporting infrastructure improvements related to biofuels. Another $10 million in grants supports advanced biofuel industries that reduce GHG emissions by 50% compared to conventional fuels.

Work with us: Unison Energy’s CHP systems dramatically reduce CI scores and, if combined with carbon capture technologies and/or renewable fuels, further reduce a biorefinery’s CI scores. In addition, clients with large organic waste streams can leverage the bill’s digester-related tax credits while using the resulting biogas in a CHP-based microgrid.

Carbon Capture & Sequestration: The IRA extends and increases the Section 45Q tax credits

By 2033: Carbon capture & sequestration (CCS) projects placed in service after 2023 or beginning construction before 2033 can take advantage of the increased 45Q tax credit. The credits range from $65/MT for enhanced oil recovery to $85/MT for full CCS. The total value depends on meeting wages and apprenticeship requirements. The IRA also broadens the definition of facilities qualified for this incentive.

Work with us: Unison Energy partners with CCS vendors to install systems for our clients, while our microgrids supply the power for the process. In about 12-24 months, we expect CCS for CHP and boiler exhaust to enable facilities to decarbonize their facilities completely.

Electric Fleets: The IRA offers commercial clean vehicle credits up to $40,000

By 2033: Based on IRC 45W, businesses and tax-exempt organizations can qualify for a clean vehicle tax credit of up to $40,000 for purchasing a qualified commercial clean vehicle. The credit is the lesser of 30% of the basis of the vehicle or the incremental purchase price above the price of a comparable RICE vehicle. This credit will compel more widespread adoption of electric medium- and heavy-duty trucks, making it cheaper to own an electric truck in many cases.

Work with us: Unison Energy can incorporate commercial EV charging as part of a microgrid system to support your facility’s energy needs with greater cost certainty. With an on-site hybrid microgrid, you can accelerate EV fleet deployment and provide the resiliency you need to make sure your EV trucks roll every day.

Make the Most of the IRA Incentives

The Inflation Reduction Act provides powerful incentives to help facilities take steps on the Energy Transition, but the timeframe is limited. Start planning now with a partner who can help you with the ins and outs of the process.

Unison Energy can assess your site and recommend a microgrid solution that will maximize the financial benefit for your facility. Contact us here.

Energy insights, delivered

Subscribe for more content.

Related Blogs

The Texas Infrastructure Resiliency Fund: Empowering Businesses with Onsite Microgrids

Canadian Carbon Reduction Incentives: What You Should Know

The Problem with Carbon Offsets