Policy Whiplash: Why Data Centers Must Take Control of Their Power Now

We are entering a new era where policy changes can reshape operational plans overnight. On-site generation provides the energy autonomy needed in this shifting environment.

The meteoric rise of artificial intelligence has created unprecedented demand for data centers across the United States – but restrictive policies threaten to dampen and delay this infrastructure boom. Due to the sheer size of data center projects and citing concerns for impacts to residential and commercial customers from investments to support data centers on already strained electrical grids, regulators are developing policies directly aimed at data centers.

What was once a relatively straightforward process of securing grid interconnection has become an evolving patchwork of policies, with Texas and Virginia leading the charge in legislation that complicates project planning and site readiness. But simultaneously, recent federal executive orders streamline permitting for qualifying AI-centric facilities. The resulting legislative uncertainty introduces significant risks to initial project designs, costs, and timelines, leaving traditional utility-dependent energy development increasingly vulnerable to policy-driven disruptions.

It is imperative that data center developers understand what these legislative shifts entail, and how they can adapt their power acquisition strategies accordingly.

How States Are Rewriting the Rules

The mix of state regulations emerging across the country shows a clear trend toward greater oversight for large energy consumers.

Texas: Leading the Charge with the “Kill Switch” Bill

Texas Senate Bill 6, enacted in June 2025, sets a new precedent for large-load oversight. The law compels facilities consuming 75 MW or more to accept mandatory curtailment during emergencies, as well as pay full interconnection and transmission study costs – a direct response to regulator concerns about ratepayer cross-subsidies.

The new law also mandates the installation of remote disconnection equipment as a condition of grid interconnection, which earned the bill the nickname “Kill Switch Bill” among industry observers.

SB 6 can be interpreted as a follow-up to Texas Senate Bill 2627 from 2023, which allocated billions in funding to incentivize construction and upgrades to gas-fired power plants following the energy crisis following 2021’s Winter Storm Uri. After addressing the “supply side” of energy in SB 2627, SB 6’s focus is managing large-scale electricity demand.

Virginia and the Interconnection Crisis

The Northern Virginia region, home to 13% of global data center capacity and the largest data center market globally, illustrates the consequences of unchecked load growth. Dominion Energy’s interconnection backlog has swelled beyond 40 GW of proposed projects, creating substantial delays. In August of 2024, Bloomberg reported up to a seven-year wait for new applicants for Dominion Energy.

Several Northern Virginia counties [CM1] have seen significant public backlash to data center density, leading to new comprehensive local ordinances that restrict deployment. Fairfax County now requires data centers to be at least 200 feet from residential areas, conduct noise studies, and maintain a minimum one-mile distance from Washington Metro stations. Prince William County is amending noise regulations after residents complained about constant mechanical buzzing from nearby Amazon Web Services data centers. Loudoun County eliminated “by-right” zoning for data centers in March 2025, requiring all future projects to undergo individual board approval.

In September 2025, the Virginia State Corporation Commission advanced a proposal to create a new large-load customer class tariff for data centers. This tariff would shift stranded asset risk away from residential ratepayers by requiring data centers to directly cover more of the costs associated with transmission upgrades and long-term power planning.

State-by-State Regulatory Snapshot

| State | Policy / Law | Threshold / Scope | Year Enacted | Key Requirement / Effect |

| Texas | SB 6 (“Kill Switch”) | ≥ 75 MW loads | 2025 | Mandatory remote curtailment capability; cost-sharing for interconnection infrastructure |

| Oregon | HB 3546 | Large industrial consumers using ≥ 20 MW loads | 2025 | New classification for large load users; long-term contract minimums; costs for new transmission |

| California | SB 57 | Major consumers (e.g., data centers) | 2025 | Requires special tariffs on large energy consumers to protect smaller rate classes and support clean energy goals |

| Georgia | PSC rule changes | > 100 MW customers | Jan 2025 | Mandates minimum billing and longer contract durations |

| South Carolina | Utility pricing adjustments; Bill 3309 | Commercial / industrial users >100 MW | 2025 | Allows higher, specialized rate structures and longer contracts for data center loads |

| Utah | SB132 | Large-load data center customers | 2025 | Ensures large load consumers bear rate, transmission, and upgrade costs so these costs are not passed on to residential rate pools |

| Virginia | Utility pricing adjustments ; SCC tariff proposal | Large-load data center customers | Proposed (Sept 2025) | Proposes a new “large-load customer class tariff” to shift stranded asset risk away from residential ratepayers by requiring data centers to cover more transmission and long-term planning costs |

The Domino Effect: What Other States Are Doing

The legislative momentum extends well beyond Texas, with several states implementing targeted utility oversight for large energy users.

Georgia’s Public Service Commission’s January 2025 rule change enables Georgia Power to set minimum billing requirements and longer contract durations for customers exceeding 100 MW, which are mainly data centers.

South Carolina has empowered utilities to charge special higher rates to data centers, while Utah enables direct power contracts that bypass residential rate pools. Each state’s approach reflects local political priorities and grid conditions, creating a complex compliance matrix for multi-state operators.

California’s SB 57 permits the public utility commission to assess the impact of major electricity consumers such as data centers on the electric rates of residential, small business, and agricultural customers. Subsequently, this commission can identify opportunities to mitigate cost shifts.

Federal Policy: Acceleration Versus State Resistance

While states race to implement restrictions and regulations, federal policy has demonstrated aggressive support for AI infrastructure development. President Trump’s July 2025 Executive Order “Accelerating Federal Permitting of Data Center Infrastructure” seeks to fast-track federal permitting for AI-centric data centers requiring over 100 MW of power. The executive order implements requirements from America’s AI Action Plan, which identifies AI infrastructure as a critical component of the American economy and national security.

The order and AI Action Plan together promise significant benefits for qualifying projects. It enables developers to sidestep Environmental Impact Statements, which had a median completion time of 34 months over the past five years. The FAST-41 process, which is designed to improve federal agency coordination and timeliness of environmental reviews, will be expanded to cover all data center and related energy projects under the AI Action Plan. Categorical Exclusions to the National Environmental Policy Act (NEPA) for relevant data center actions will also be established, further accelerating environmental permitting. Federal land use changes have also made new Interior, Energy, and Defense Department properties available for development.

Onsite Generation as a Strategic Response

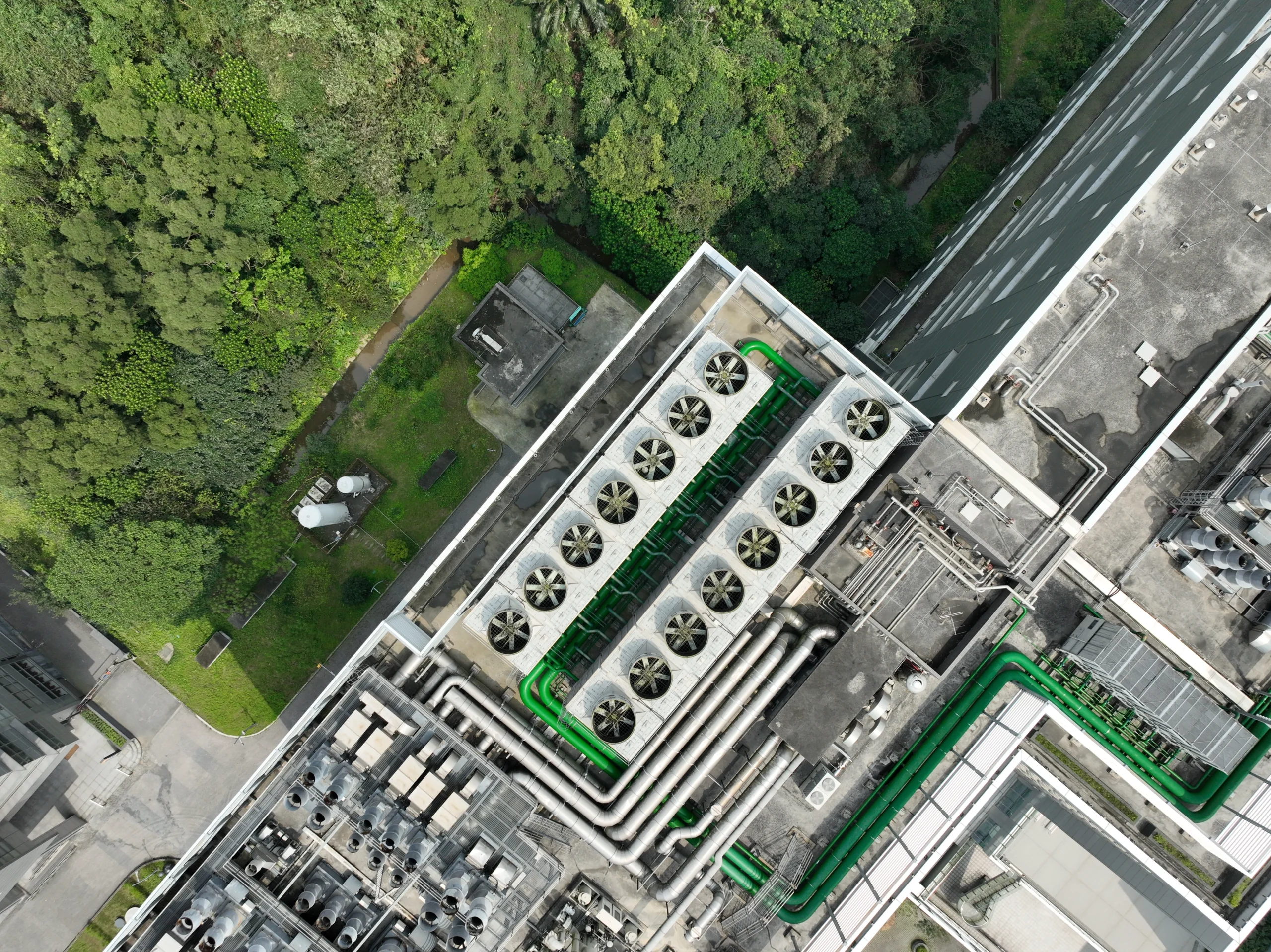

With growing legislative risk reshaping power availability, traditional utility-dependent models are highly vulnerable. Onsite generation (microgrids) give data centers a competitive advantage since they help maintain uptime, accelerate deployment timelines, and support strained utility infrastructure.

Onsite generation can be designed in two kinds of configurations, each addressing different regulatory scenarios:

- In an islanded configuration, a microgrid can operate entirely independently of the utility grid, providing protection against curtailment mandates and utility outages. This approach is particularly valuable in markets like Texas, where remote disconnection requirements introduce operational vulnerability and utility interconnection infrastructure is costly, or in Virginia, where interconnection delays threaten deployment schedules.

- Grid-parallel configurations offer a different value proposition, enabling facilities to operate in coordination with utilities while maintaining the capability to island during emergency conditions. This approach also allows data centers to export excess capacity back to the grid when permitted, creating a potential new revenue stream that supports local reliability efforts.

When paired with Combined Heat and Power (CHP) systems, microgrids become even more efficient. CHP units provide continuous, on-site electricity while capturing waste heat to support the cooling loads critical for high-density data centers. The result is a scalable, fuel-flexible system that supports deployment timelines, reduces operational risk, and maximizes energy value while offering islanding capabilities during curtailment.

Unison Energy’s Turnkey Site Readiness Model

Unison Energy provides a turnkey onsite generation solution. Unison will design, build, own, and operate an onsite generation system for data centers.

Our comprehensive solution addresses policy compliance and technical execution through early-stage services, including emissions screenings, fuel supply feasibility studies, permitting preparation, and site layout optimization.

Our Energy-as-a-Service model eliminates upfront capital requirements while providing predictable operating costs. We also offer Design/Build and Operations & Maintenance contract structures with ongoing technical support.

As legislation accelerates, timelines tighten, and interconnection delays mount, the time to act is now. Unison Energy can support data centers to secure power resilience, regulatory compliance, and cost stability – before policy shifts stall your next data center project.

Energy insights, delivered

Subscribe for more content.

Related Blogs

Onsite Generation – Part of the Power Stack

Modernizing Hospital Power Infrastructure: Achieving CMS Compliance and Long-Term Resilience with Onsite Microgrids

The Energy Crisis in Healthcare: Mitigating Financial Losses Through Reliable Power Solutions