Decarbonizing Fuels: Alternative Fuels for Today, Tomorrow and How We Get There

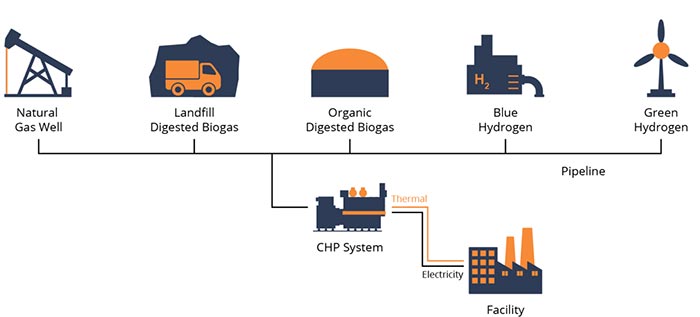

Today’s natural gas-powered microgrid systems will be able to integrate low-carbon hydrogen and biogas as these promising technologies become available.

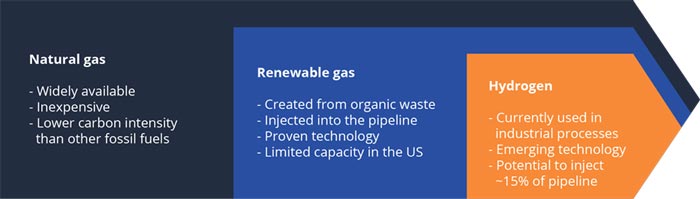

As the United States undergoes an energy transition, the natural gas pipeline system is expected to keep pace by adding renewable fuels into the pipeline mix. The natural gas pipeline system has three key advantages: energy is available on-demand, access is near ubiquitous, and the underground pipeline system is highly resilient to storms. Although natural gas is much cleaner than other fuels, it isn’t zero carbon. Understanding that intermittent energy from wind and solar has its own drawbacks and that electrification of boilers is expensive (and in some cases infeasible), pipeline companies are actively working to reduce their carbon intensity even further to provide a more complete solution.

Biogas and hydrogen are quickly becoming popular fuel alternatives in society’s search for low-carbon energy solutions. While these technologies require further investment and adoption, they are already making inroads. Facilities reimagining their energy plans for the next 10-20 years will consider how hydrogen and biogas should factor into their decisionmaking today.

Facilities investing in on-site energy generation powered by natural gas can see immediate emission reductions (30-40%), then will be able to seamlessly incorporate hydrogen and biogas to allow for further reductions or even carbon neutrality down the road.

The Basics, Benefits, and Future of Biogas

Biogas is a fuel created from organic materials that are increasingly injected into the natural gas pipeline to reduce end-user emissions.

Biogas is a renewable alternative to natural gas and is sometimes referred to as renewable natural gas (RNG). It is created through the anaerobic decomposition of organic materials and helps prevent methane, a potent greenhouse gas, from otherwise escaping into the atmosphere. RNG can be used as vehicle fuel, for electricity generation, or as a fuel for thermal applications. Once cleaned to an appropriate level it can be directly injected into the pipeline, reducing the carbon intensity of the pipeline gas.

Pipelines are increasingly adding renewable gas + hydrogen to the mix

In the U.S., there are about 2,200 sites producing biogas (with some 18,885 biogas plants in Europe), while studies have suggested there are nearly 15,000 U.S. sites that could be developed to produce biogas, including landfills, farms, water resource recovery facilities, and food waste sites. In 2019, the Energy Information Association (EIA) estimates 426 biogas plants produced a total of 11.7 billion kWh of electricity (10.5 billion kWh from 336 landfills, 1.0 billion kWh from 65 wastewater treatment plants, and 0.2 billion kWh from 25 large dairies).

Biogas-based combined heat and power (CHP) projects have become common. As of 2020, some 121 biogas anaerobic digesters were in use for CHP in the U.S. In Germany, there are nearly 11,000 anaerobic digesters and since 2000, plant operators have been able to receive feed-in tariffs for the power they send to the grid. Italy is the second-largest European biogas producer, with over 1,600 digesters.

Historically, biogas has been produced and used at the same location. Today, refined biogas is commonly injected into natural gas pipelines, using a “point of receipt” that monitors the gas quality and a pipeline extension to transfer the gas to the pipeline. At least 55 natural gas companies across the U.S. accept RNG into pipelines. The next step is to scale up that production. As an indication of the direction of the industry, CR&R recently announced it would be the first commercial-scale California operation to specifically produce renewable natural gas for direct injection into the pipeline. The waste company will collect organic waste from 15 municipalities to be processed at the plant.

The Current Use and Future Potential of Hydrogen

With further development in green and blue hydrogen production, hydrogen could be a low-emission fuel of the future.

Hydrogen is a ‘clean’ fuel that produces only water when consumed as a fuel for power generation. Hydrogen production is common, with 70 million tonnes produced globally. Today, hydrogen use is dominated by industry — oil refining, ammonia production, methanol production, and steel production. It is used in some cases for transportation but more importantly, it could be used in power generation and blended into natural gas pipelines for more widespread usage.

Low-carbon hydrogen is produced through one of two techniques commonly referred to as “blue hydrogen” and “green hydrogen.” In the U.S., 95% of hydrogen is produced through natural gas reforming, an established and relatively low-cost production process that produces carbon emissions. But this process can also be used as part of the “blue” hydrogen method, which incorporates carbon capture and sequestration (CCS) to capture about 70-95% of the resulting emissions.

Another technique, electrolysis, splits water into hydrogen and oxygen. This is referred to as “green” hydrogen when the electric current comes from solar, wind, tidal, or otherwise renewable energy. Green hydrogen currently accounts for less than 0.1% of the global supply. Currently, green hydrogen is about 2-3x more expensive than blue hydrogen, but costs are predicted to fall by 30% by 2030.

Today, hydrogen is typically produced at dedicated facilities for large industrial sites, which requires significant facility investment. Centralized, commercial-scale hydrogen production is more cost-effective but incurs distribution costs. For local delivery, dedicated hydrogen pipelines are a feasible option. Delivery by existing natural gas pipelines is also possible and incurs lower costs as the infrastructure already exists. Hydrogen can be mixed into the existing natural gas pipeline at concentrations of 5-15% without risk of pipe degradation.

Hydrogen has been demonstrated as a fuel for both utility-scale power projects and on-site combined heat and power (CHP) installations. In Germany, the local utility Stadtwerke Hassfurt partnered with 2G Energy to generate green hydrogen, use it in a hydrogen-only cogeneration system that reaches over 80% efficiency, and ultimately supply customers in the region with heat and electricity. In another example, 2G Energy is providing a CHP system to the Kirkwall Airport in Scotland that will support the main building’s thermal and electrical loads. This trial run implementation will be powered by green hydrogen supplied by the European Marine Energy Centre Ltd, which uses tidal power to power electrolysis. This is the first 100% hydrogen on-site generation CHP system in the UK.

As a whole, the EU plans to have 6 GW of electrolyzers for green hydrogen installed by 2024. Hydrogen currently represents a $150 billion market globally, which could grow to $600 billion by 2050 to potentially meet a fifth of energy demand worldwide as pipelines continue to innovate to reduce the carbon intensity of pipeline gas and power generation seeks options for carbon-neutral, on-demand capacity.

CHP Infrastructure Today Can Incorporate Decarbonizing Fuels Tomorrow

It makes sense for facilities to be prepared for hydrogen and biogas — but it also makes sense to cut emissions as much as possible now, rather than wait for these technologies to mature. By choosing a combined heat and power (CHP) microgrid today, a facility can typically reduce emissions by 30-40% by burning natural gas directly, versus using utility power.

Unison Energy’s CHP engines installed today are ready for both biogas and hydrogen as it becomes more readily available in the future. Pipelines will increasingly shift to these alternative fuels over the next 10-20 years to reduce the carbon output of fossil fuels and support carbon neutrality goals.

To learn more about how a Unison Energy microgrid can support EV fleet charging, click here to contact a Unison Energy sales representative.

Energy insights, delivered

Subscribe for more content.

Related Blogs

The Energy Crisis in Healthcare: Mitigating Financial Losses Through Reliable Power Solutions

Deadlines for the Inflation Reduction Act

Canadian Carbon Reduction Incentives: What You Should Know