The Inflation Reduction Act

Unison Energy can help your facility take advantage of tax credits offered by the historic Inflation Reduction Act.

The Energy Transition is here, with the passage of the historic Inflation Reduction Act (IRA). As the largest-ever action on climate and energy, the bill offers $369 billion in funding designed to lower greenhouse gas (GHG) emissions 40% by 2030, compared to 2005 levels.

The bill offers tax incentives that will push rapid technological developments and major shifts in how industries buy, generate, and store energy. To take advantage of these temporary financial benefits and meet your sustainability goals, there is a narrow window to act before the IRA expires at the end of 2024.

The IRA Includes a 30% Tax Credit for Microgrids

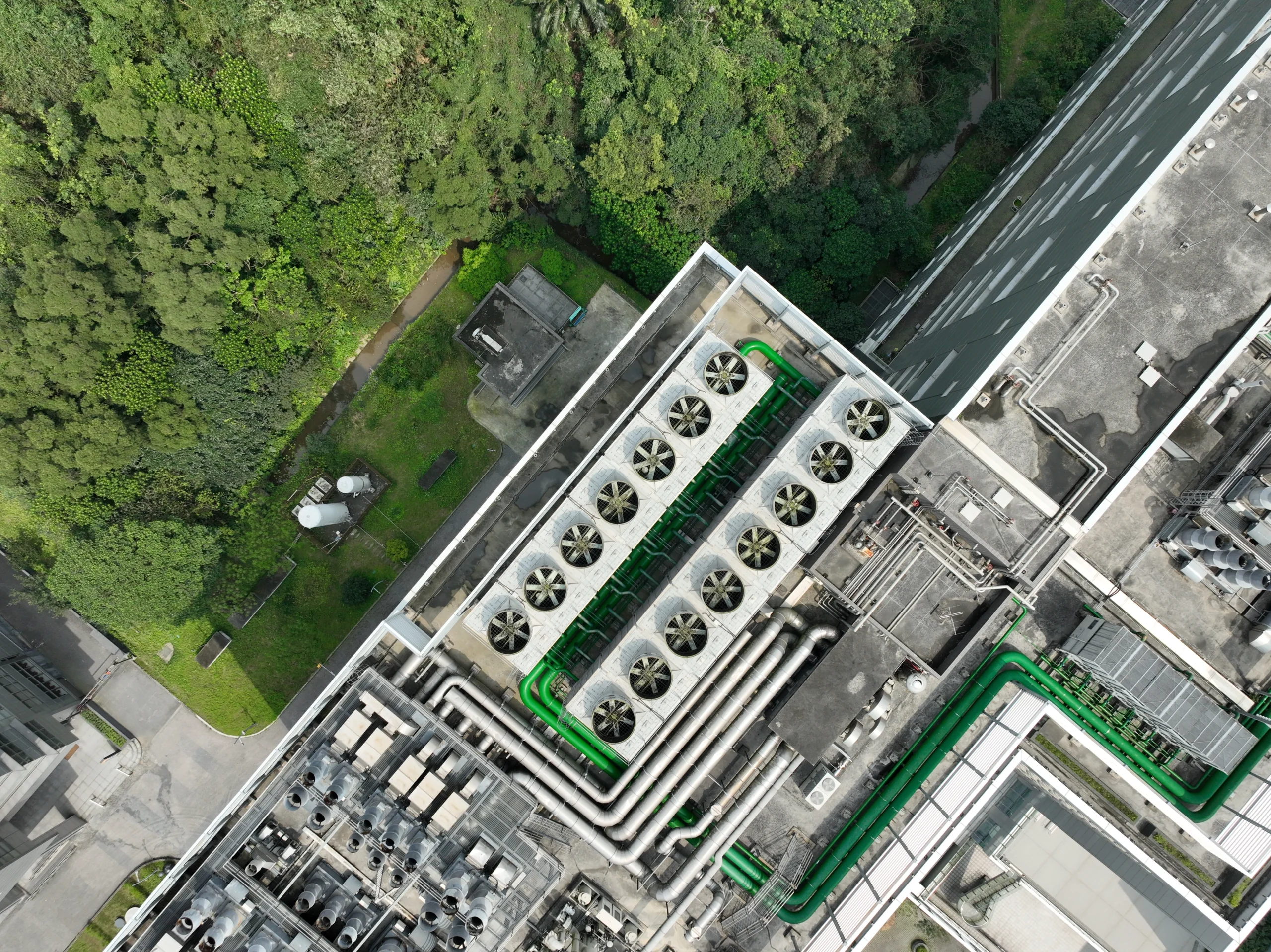

If your facility is considering a microgrid, the passage of the IRA is a major boost. The bill offers a 30+% investment tax credit for clean energy projects that start before the end of 2024, applicable for a wide range of technologies such as combined heat and power (CHP), solar, battery storage, microgrid controllers, microturbines, fuel cells, and biogas. Additional 10% bonuses are available for systems using domestically manufactured equipment and for certain brownfield sites.

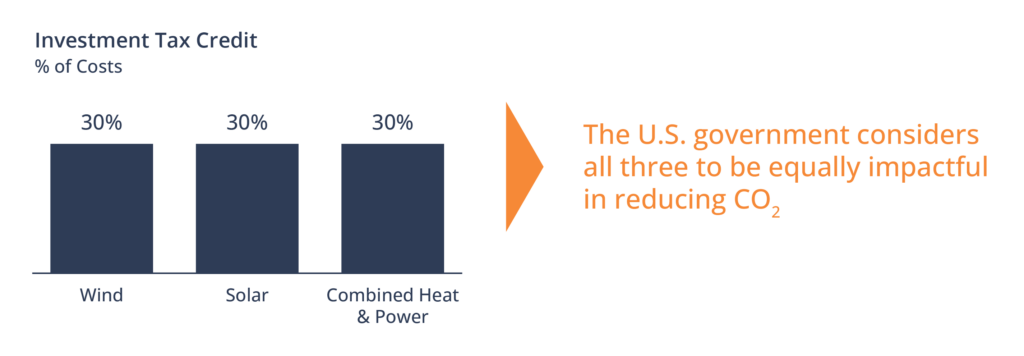

CHP Is Considered as Impactful as Solar and Wind for Decarbonization

The tax incentive for CHP is increased to 30% along with wind and solar. Unison Energy research has shown that a well-designed CHP system can reduce carbon as effectively as on-site solar for facilities with significant boiler or chiller use. By making them equal, the U.S. government supports this view.

Microgrids Can Also Support the EV Charging Transition

The bill also includes several incentives that will rapidly lower the cost of switching to electric fleets. To support the energy needs of those fleets, while ensuring resiliency and cost certainty, Unison Energy is able to incorporate commercial EV charging as part of a microgrid.

The IRA Promotes the Development of Alternative Fuels

The IRA increases funding for alternative fuels such as hydrogen and RNG, bringing these options closer to widespread viability. The bill supports hydrogen with up to $3/kg for low-carbon production, while expanding tax credits for biogas projects. Unison Energy’s CHP systems can utilize alternative fuels that are available at a feasible cost and volume, offering additional emission cuts beyond the typical 30-40%. For instance, clients with large organic waste streams can take advantage of the bill’s digester-related tax credits while using the produced biogas in their CHP-based microgrid to make additional carbon reductions.

The IRA Extends Carbon Capture & Sequestration Tax Credits

The bill also extends and increases the value of the Section 45Q tax credits for carbon capture & sequestration (CCS) projects that begin construction before 2033. This provides a path for full decarbonization (net zero) for industrial and manufacturing facilities. In the near term, this will support the development of CO₂ pipelines, which require compressors with large electric loads. Unison Energy is working with CCS vendors to install systems for clients, while supplying the power for the process through our microgrids. In the medium term, carbon capture systems for CHP and boiler exhaust will enable facilities to decarbonize their facility completely. The technology is currently in demonstration and expected to be commercially available in 12-24 months.

Financing Is Easier Than Ever

Historically, accessing the Investment Tax Credit for third-party financed microgrids required a complicated financing structure. The IRA has made the transferability of the tax credits seamless, making it easier to secure financing for these projects. What’s more, the IRA offers incentives for efficiency upgrades, including the boilers, chillers, and central plant upgrades that can be incorporated into our Energy-as-a-Service (Eaas) model with no upfront capex from our clients.

Get Started on the Energy Transition

Unison Energy can assess your site and recommend a microgrid solution that will maximize the financial benefit for your facility. Incorporating a variety of technologies, Unison can provide a custom turnkey microgrid solution: we design, build, operate, and maintain the system, with no capital required using a long-term Energy Services Agreement (ESA); our clients pay only for the energy (kWh, therms) used. With the passage of the IRA, facilities have a greater incentive to begin the path to carbon neutrality at their facilities, with a microgrid that offers decarbonization, resiliency, and cost savings.

Unison Energy’s microgrids help companies lock in lower energy costs, energy resiliency, and reduced carbon footprints. Click here to contact a Unison Energy sales representative.

Energy insights, delivered

Subscribe for more content.

Related Blogs

Policy Whiplash: Why Data Centers Must Take Control of Their Power Now

The Energy Crisis in Healthcare: Mitigating Financial Losses Through Reliable Power Solutions

Deadlines for the Inflation Reduction Act