Navigating the Inflation Reduction Act’s Domestic Content Bonus Credit

The IRS’s domestic content bonus credit under the Inflation Reduction Act (IRA) can increase tax credits by 10% for energy projects that incorporate U.S.-made parts. Here are the requirements you need to know.

The Internal Revenue Service (IRS) recently released guidelines regarding the Inflation Reduction Act’s (IRA) domestic content bonus credit. This bonus applies on top of the 30% Investment Tax Credit (ITC) available for cogeneration, solar, battery storage, and wind projects that each have specific requirements, mostly around prevailing wage and apprentice programs.

Put simply, you could receive an additional 10% tax credit if you use a significant portion of U.S.-made materials and components in constructing your energy project. Here’s how this bonus credit could impact your energy projects and facilities.

Basics of the Domestic Content Bonus Credit

The domestic content bonus credit boosts the ITC for a qualifying project by 10%. However, if the project does not meet certain prevailing wage and apprenticeship requirements, this boost drops to 2%.

To receive the bonus, your project must meet the “domestic content requirement.” This means that a predetermined amount of your project materials and components (Manufactured Products) must be made in the U.S., as explained further below.

In addition, a statement should be submitted to the IRS, affirming that the applicable project complies with the domestic content requirement as of the operational date. As the project continues, it’s essential to keep careful track of its details to certify compliance with the materials rule, while retaining those records for tax purposes.

It’s also possible for retrofitted facilities to receive a credit, assuming you start work after December 31, 2022, the value of the used parts of the building is not more than 20% of the total cost of the project, and the new parts of the building follow the materials requirements.

Demystifying the Domestic Content Requirement

In most cases, a project can meet the domestic content requirement if it meets two conditions, which are largely based on the Buy America Requirement:

- Steel or Iron Requirement: All iron and steel in the project must be made in the U.S. This requirement is focused on structural steel, piping, rebar, etc.

- Manufactured Products Requirement: At least 40% of the cost of manufactured products used in the project must be manufactured in the U.S. This escalates to 55% at a rate of 5% per year between 2023-2026.

For manufactured products that include imported materials, analysis is more complicated. Manufacturers will be expected to disclose the origin country and direct costs for the materials and parts used in the product. The rules stipulate that the cost of these components should be based on the manufacturer’s cost of production, not the purchase price paid by the developer. This could make compliance more complex for some project developers.

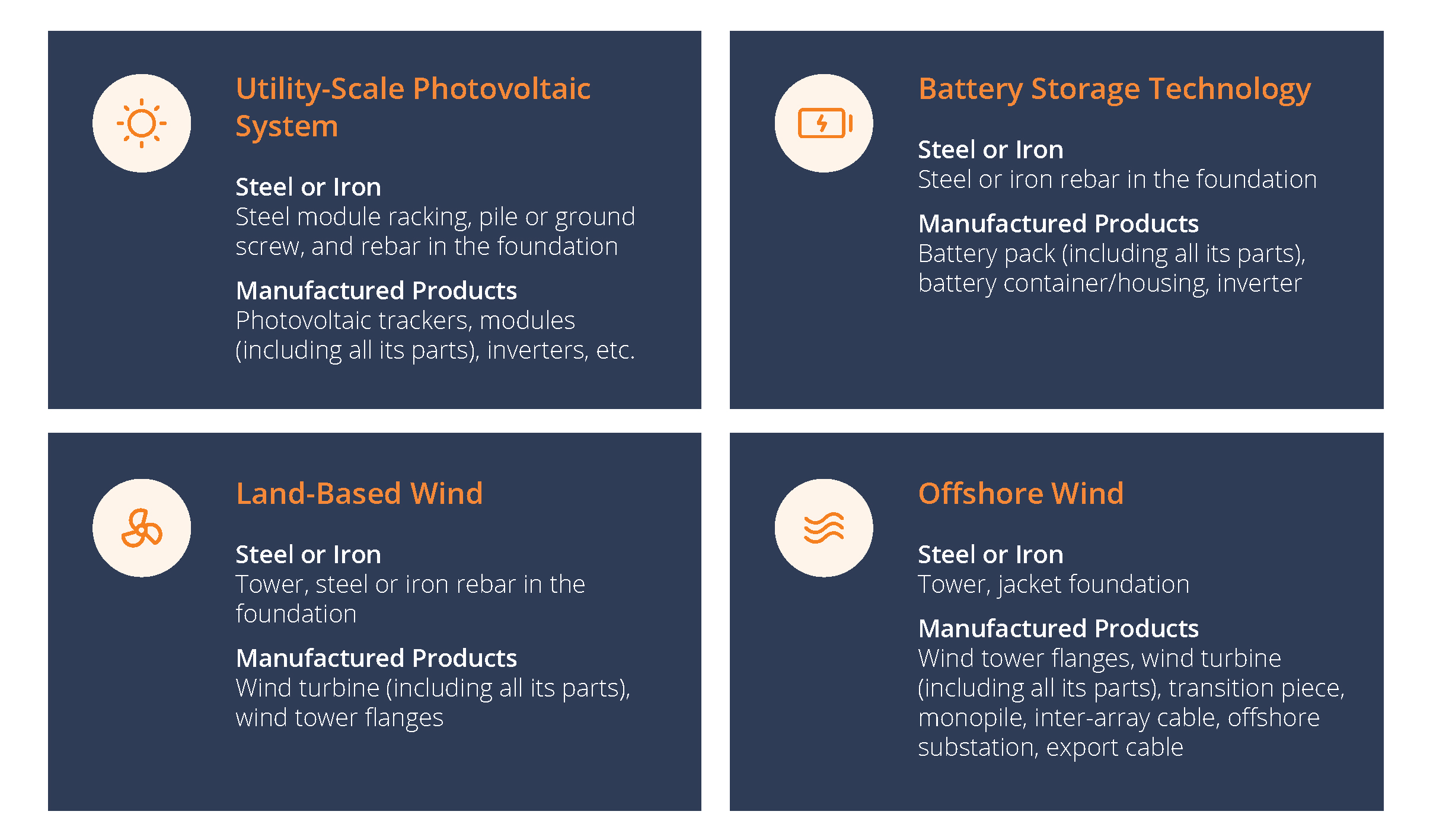

Project Materials that Count Towards the Domestic Content Requirement

The IRS notice explains that project materials will be classified as either construction materials with a structural function (falling under the Steel or Iron Requirement) or manufactured products (falling under the Manufactured Products Requirement). The published IRS guidelines cover solar and wind projects but do not currently cover microgrid projects, however, they do provide a non-exhaustive list of examples of microgrid project components that are relevant for the bonus credit:

Incorporating the Bonus Credit: A Microgrid Project Example

By way of example, imagine that Unison Energy will be developing a microgrid system for a client that incorporates cogeneration, solar energy, and battery storage. We will begin the design and construction phase toward the end of 2023, and the plan is to apply for the 10% domestic content bonus. The components used for this microgrid system could include solar photovoltaic modules, inverters, battery storage units, steel supporting structures, and a control system for the microgrid.

To qualify for the bonus, the steel structures used to support the solar modules and battery storage units have to be 100% made in the U.S. Imagining the solar panels and inverters are manufactured outside of the U.S., their costs would therefore not count toward the U.S. materials rule. However, if the battery storage units and the microgrid control system are produced in the U.S., their costs would count in favor of the bonus. If at least 40-55% of the parts are made in the U.S., the overall project would satisfy the U.S. materials requirement.

Take Advantage of the IRA with Unison Energy

Unison Energy is committed to helping our clients navigate the intricate rules and processes within the Inflation Reduction Act, maximizing incentives to lower your energy costs and carbon footprint while increasing resiliency. Having a project qualify for the 30% credit and any bonus credits makes it more feasible to invest in the energy transition and industrial decarbonization. To stay ahead of deadlines included in the IRA, the time to act is now.

To learn more about optimizing the Inflation Reduction Act benefits for your facility, please contact us.

Energy insights, delivered

Subscribe for more content.

Related Blogs

The Energy Crisis in Healthcare: Mitigating Financial Losses Through Reliable Power Solutions

Deadlines for the Inflation Reduction Act

Canadian Carbon Reduction Incentives: What You Should Know