It’s Time To Reconsider Cogeneration

Cogeneration-based microgrids systems are increasingly attractive to many facilities as the market’s financial, logistic, and regulatory barriers fall.

Many facilities that evaluated and decided against cogeneration in the past are reassessing their decision. The on-site generation market has changed over the past decade, and many of the hurdles that historically prevented facilities from adopting combined heat and power (CHP) microgrid systems have been overcome or fallen away. Four key industry developments have changed the market to the benefit of CHP adopters across the U.S.

The Economics of CHP Have Improved

The cost of natural gas is much more predictable today, leading to more consistent savings with a CHP system vs. the utility.

Thanks in large part to the shale gas revolution, the cost of natural gas today is lower and less volatile compared to past decades, and should remain so for the foreseeable future. Lower natural gas costs help make CHP projects more financially attractive compared to paying for utility power, while reduced price volatility makes cost savings for CHP projects more predictable relative to rising utility bills. As natural gas has grown to be the predominant fuel source for power generation in the U.S. over the past decade, electricity prices have become increasingly correlated with the commodity cost of natural gas. This means that facilities can use natural gas to generate on-site electricity and enjoy not just low gas costs, but also the knowledge that if gas prices were to go up, utility costs would also rise, maintaining the savings provided by the CHP.

Another important driver of CHP economics is rising or high utility electric rates. In significant portions of the country, the electric grid has become aged and congested; utilities must invest capital to upgrade equipment and add new generating capacity. Upgrades to the grid, such as those necessitated by the recurrence of wildfires in California and increasingly severe storms on the Gulf and Atlantic coasts, are extremely costly and lead to higher utility rates for customers. On-site power generation helps facilities avoid or mitigate these rising utility rates.

Most Utilities Now Support Cogeneration Deployment

Utilities are increasingly fast-tracking CHP interconnections as a means of easing grid congestion and reducing the need for capital investment in new generation capacity or distribution system upgrades.

Historically, utilities were not always amenable to losing customers to distributed generation solutions such as CHP microgrids or solar. Without utility support for interconnections, installing any form of on-site generation was out of the question. However, the utility industry has been aggressively deregulating since the late 1990s and distributed generation has been growing rapidly across the country. Now utilities increasingly see CHP as beneficial to both their financial health and the health of the grid, so cogeneration has become a feasible option in most utility territories across the U.S.

Following the explosive growth of the solar industry (an average growth rate of 49% each year from 2010 to 2020), utilities have had to adjust and offer more options for interconnections. In addition, utilities with aging grids benefit from the on-site generation that helps relieve grid congestion. Utilities like Pepco, Baltimore Gas and Electric, National Grid, and Eversource Energy now view CHP as an effective way to help alleviate load from their overburdened infrastructure while also mitigating the costs of upgrades and the cost of demand.

Utilities in some regions have specific reasons for encouraging CHP microgrids. In 2012, the California Public Utilities Commission (CPUC) ruled utilities may enact Public Safety Power Shutoffs (PSPS) in order to help prevent wildfires in hot, dry, and windy conditions. However, as these PSPS events have become commonplace over the last two years, facilities and communities have been left without power for multi-day stretches – often during the hottest months of the year, creating an additional set of safety risks for utility customers. In response, the California legislature now actively supports the deployment of microgrids across the state as a means of mitigating these outages, exemplified by the passage of Senate Bill 1339 in 2018.

Resiliency, Sustainability, and Energy Efficiency Are Increasingly Important

Facilities are increasingly driven to ensure resiliency and prevent costly outages, while simultaneously seeking aggressive solutions to cut carbon footprints.

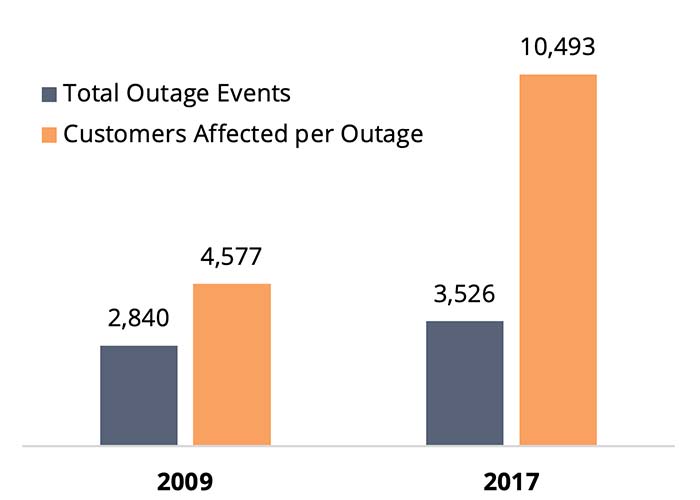

Power Outages are More Widespread

U.S. Nationwide

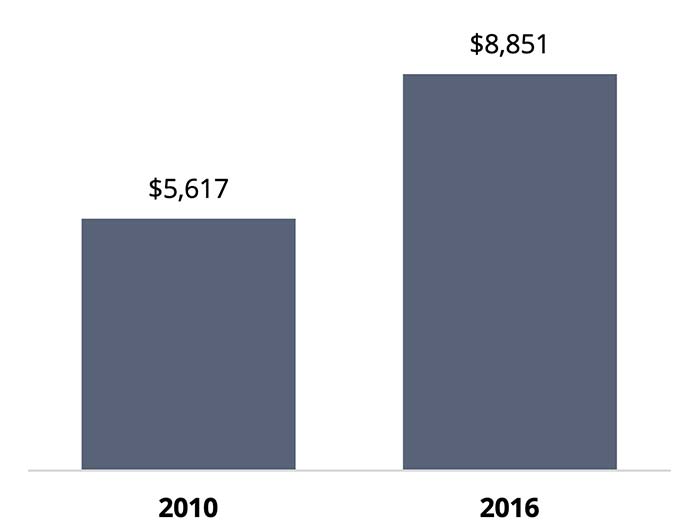

Power Outages are More Damaging

U.S. Data Centers, Outage Cost per Minute

Storms, wildfires, and severe weather events are causing more frequent utility outages. These outages are having an increasingly widespread impact while causing rising costs in the commercial and industrial sectors. The 2018 State of Commercial & Industrial Power Reliability report from S&C Electric found that 18% of companies have suffered a loss of $100,000 or more as a result of their single worst outage in 2017. Half of the companies reported outages of one hour or more in the past year, and a quarter said they experience outages on at least a monthly basis. Because of the risk of these “black swan events,” facilities are focused on finding resilient energy solutions that allow for on-site energy generation when the grid is down.

At the same time, many facilities are making aggressive strides to cut down their carbon footprints, especially given the role global carbon emissions play in creating damaging weather events. Environmental, social, and governance (ESG) factors are commonly used by investors to evaluate a company’s sustainability and societal impact, and are increasingly used by facilities themselves to choose responsible practices and strengthen their appeal to customers. While some facilities pursue carbon credits to offset emissions, advanced technological solutions like microgrids allow many sites to actually cut a large percentage of their emissions on-site.

Similarly, energy costs have led many facilities to adopt a slew of energy efficiency measures over the last decade. The success of these lighting projects, energy-efficient plant equipment, and other low- or no-cost measures that have short paybacks and high ROI, is leading facility managers to seek out larger, more complex projects in order to further improve the energy efficiency of their sites. The exhaustion of the “low-hanging fruit” of quick-payback energy efficiency measures at most facilities is also leading energy directors and management to hone in on their energy supply to achieve further carbon and financial savings.

CHP-based microgrids allow facilities to improve energy efficiency and cut emissions to meet ESG goals, while also ensuring resiliency during utility outages. CHP systems consume natural gas at a 60-80% fuel efficiency, producing both electricity and useful thermal energy, which allows facilities to cut their carbon emissions by 20-40%, depending on the facility’s local grid. At the same time, CHP microgrids are capable of operating in island mode for days to power through and outlast storms and other extreme weather events. When Hurricane Isaias downed power grids across the eastern seaboard in 2020, CHP microgrids allowed some supermarkets to maintain full operations via on-site power for up to almost a week, until access to the grid could be restored.

Turnkey Third-Party Solutions Are More Available Than Ever

New energy-as-a-service (EaaS) models make it possible for customers to benefit from cogeneration without assuming operational or financial risk.

For many, the first question about microgrids is who is going to foot the bill for these multi-million dollar projects. The high cost of a cogeneration system has discouraged many facilities and campuses from adopting them in the past, but new financing options and third-party services in the marketplace are making microgrids more accessible than ever.

In the early days of the solar industry, facilities had to buy and own solar panels themselves — an ownership model that is largely gone. The dominant model now is to have a third party entity own and install the solar array, and then sell the power to a facility through a power purchase agreement (PPA). A similar approach is possible in the CHP-based microgrid market. An increasing number of Energy-as-a-Service (EaaS) providers, including Unison Energy, now provide turnkey CHP solutions, where they build, own, and operate the system, and then sell the power and thermal energy to a facility through an energy services agreement (ESA). The ESA requires no capital expenditure from the facility whatsoever. This opens up the CHP market to facilities that do not have the budget for costly CHP projects, or that would rather save their capital for improving their core operations.

In addition to the high upfront cost of CHP, ongoing operations and maintenance (O&M) require dedicated resources in order to ensure the CHP system is running well and providing the intended benefits. Utility plants do not run themselves after all! Many systems owned by a facility or other end-user are not correctly maintained and thus deliver poor performance, which is a major reason the end-user ownership model has fallen out of favor. The EaaS model eliminates this issue, as the owner and developer of the system assume responsibility for all O&M costs, freeing up the facility’s resources and staff to focus on its core operations. In a properly constructed ESA, the incentives of both the EaaS provider and facility are aligned: both want to see maximum efficiency and performance from the CHP system. High CHP uptime and energy savings are the results of this synergy.

By addressing both financial and operational risks, EaaS has become increasingly popular over the past decade, with little signs of slowing. The global EaaS market was worth $58 billion in 2019 and is projected to grow at a 14.6% CAGR through 2027.

Energy Savings Might Be Closer Than You Think

Higher utility rates, a less volatile natural gas market, a growing focus on resiliency and energy efficiency, and extreme weather events in recent years have made it clear that the need for efficient, cost-saving, on-site power generation that can operate independently of the grid is at an all-time high. Many of the factors that prevented the wider adoption of CHP systems have disappeared, and facilities that investigated projects before and decided not to proceed are now revisiting CHP as an attractive solution to their sites’ challenges.

With better market conditions and more customer-friendly financing options available, now is the perfect time for facilities to consider – or reconsider – whether they can benefit from a cogeneration system.

If you are reconsidering cogeneration-based microgrids for your facility, click here to contact Unison Energy.

Energy insights, delivered

Subscribe for more content.